Customer lifetime value

Every customer presents for a company different expenses and profits. Customer Lifetime Value (CLV) presents the financial profit a customer brings in for the company, calculated from the existing period to the future. CLV is an important metric used in strategic marketing. The number presents the value of your customer based on her/his returns and loyalty. Or in different words it presents how much a customer spend in your shop during entire relationship with the company.

Why you need to know CLV?

Admittedly every company has limited budget for marketing. Thanks to knowing CLV you exactly know the cumulative cash flow a particular customer would give you throughout his/her life-term. Thanks to this knowledge you can create different customers segments. It allows you than to split your effort and mostly budget into more and less profitable customers. Once you recognize your most profitable customers using CLV, you can optimize the allocation of your resources for maximum profits. You can also customize your future marketing strategies for a specific audience.

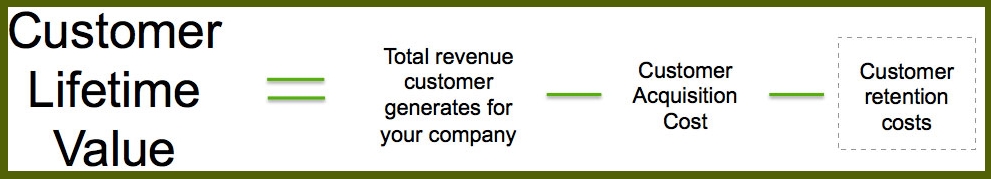

How to calculate CLV?

There are many methods and theories how CLV can be calculated. The most relevant way for us how to calculate CLV is to take revenue you earn from a customer and subtract out the money spent on acquiring and serving them. CLV can be calculated also historically but it can also be predicted. It is always useful know both – historic and predictive CLV for analyzing this numbers and know not only what a customer is worth to you now, but also how their value will change overtime.